There is a variety of different assets in the world of investments. Each instrument or type of investment varies in its returns, methods, time period, and risks. Some investment types like CFDs or Contracts for Differences increase the risks and in return gains. CFDs are also unique, in that you do not need to actually purchase any asset fully.

Contracts for What?

To eliminate the risk of confusion and intimidation, let’s start with explaining exactly what CFDs are. CFDs or Contracts for Differences are arrangements made between a buyer and a broker, where the buyer assumes responsibility for the difference of loss or gain at the end of the contract execution time. What does that mean exactly? Well, CFD is a tradable contract between a client and a broker, in which the parties (buyer & broker) exchange the value of the asset at the beginning and end of a contract.

In a CFD you do not actually purchase the asset on which you are investing, but rather you purchase the gains or losses of the asset from start of the contract to the end of the contract. So, when you purchase a CFD, the seller or broker continues to own the actual asset, but the buyer buys the right to the profits and losses of the asset beginning to end of the contract.

Leveraged CFDs

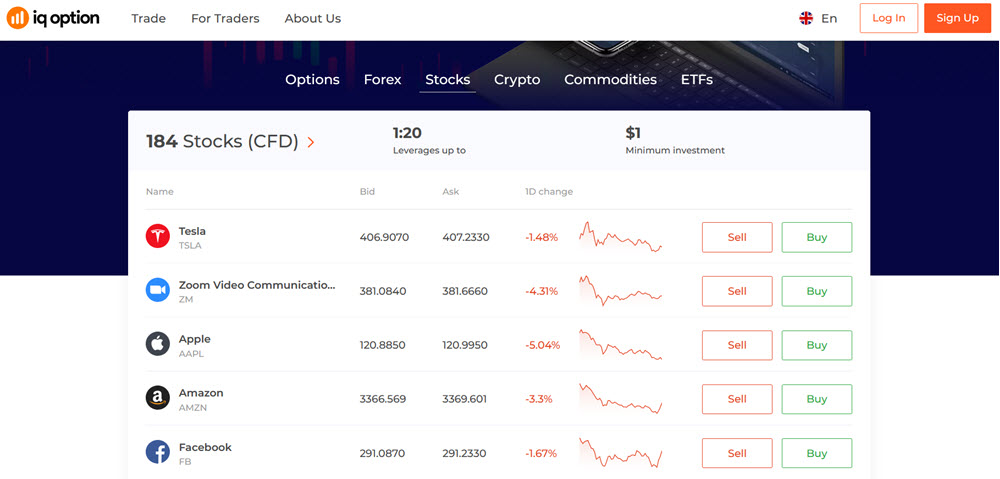

CFDs are a leveraged product. What exactly does that mean? Leveraged products are investments that require only a small portion of the full value of the trade to open a position. You can see how this can be intriguing for people who don’t have the money to buy the asset at full price. When that same product is leveraged than you can buy the rights to that product for pennies to dimes on the dollar. This is most often referred to as ‘Trading on a Margin’. While trading on a margin is great in the eyes of some for its benefits, others are terrified of its risks.

CFDs are leveraged between .5-20%. This is a much higher leverage than most traditional trading instruments. Mathematically speaking, that means that if a stock is $1,000, leveraged at .5%, then you will only need $50 to buy a position. That’s also where the major risk comes in. When you lose while trading on margin you can lose a lot more than what you invested. Losing 5 to 50 times your investment can destroy most investment careers before they start.

Math Behind CFDs

You invest in CFDs based on how you believe the market will move. Your CFD can be on many instruments like currency pairs, commodities, shares, stock indices, and treasuries. Let’s go over an example to give you a better understanding of how you will make or lose money with CFDs.

For this example, we will use a share of a stock valued at $100 at the beginning of the contract. A 10% leveraged CFD will only require you to pay $10 per share rather than $100. Let’s pretend you bought 50 shares. If the stock you invested in raises in value from $100 to $150 before your contract runs out, this is considered a difference of 5p which will net you a gross profit of $250 on your 50 shares with a closing commission on this position of $50.

The same math is applied in reverse for a downward movement on your chosen instrument. This is why proper research is crucial to any and all investments. Especially if trading on a margin. Inform yourself properly before you invest on a leveraged product, to protect yourself from multiplied losses that exceed your investment and budget.